Sustainable packages for startups

How can we build sustainable relationships with startups in the early stages of development?

The aim of this research project was to identify the needs and pain points of startups, as well as their perceptions of “ABC” bank, in order to build a sustainable long-term relationship with startups. Additionally, the project aimed to provide recommendations to the bank based on the findings of the analysis.

“ABC” bank has a Center of Innovative Entrepreneurship that provides mentorship for startups in their early stages of development. The bank wanted to attract startups in their early stages of development and understand whether fintech was a primary competitor in the financial sector, and whether incubators/accelerators were non-financial competitors.

Note: The bank name has been changed for privacy reasons

Research Methodology:

To achieve the goals of the project, I conducted a thorough analysis of the startup ecosystem and interviewed key stakeholders, including startups and representatives from the bank’s Center of Innovative Entrepreneurship. Based on the insights gained from these interviews, we developed a survey to gather feedback from a wider range of startups.

The survey was delivered to 100 startups in Slovenia and included questions that aimed to identify their needs, pain points, and perceptions of “ABC” bank. The survey was conducted over a period of seven days, during which we received a total of 30 responses. Of these responses, 21 were fully completed and included in the analysis.

Designing the survey for quantitative research

The online survey tackled two managerial decisions:

1. To determine the needs of startups in terms of financing and support

2. To determine the factors that impact startups when choosing one bank over another

The research questions served as a guideline, along with the qualitative interviews, to form hypotheses:

1. Startup concerns are predominantly non-financial

2. Startups do not perceive banks as the main source of non-financial support

3. Startups perceive location as the most important attribute when deciding on a financial provider

4. The majority of startups are not familiar with the Center of Innovative Entrepreneurship

5. The trust of startups in Fintech and traditional Banks is not the same

The purpose of forming hypotheses was to provide guidance for statistical analysis and to ultimately determine whether there were statistically significant differences that could prove or reject the formulated hypotheses. To achieve this, hypothesis testing was performed using R.

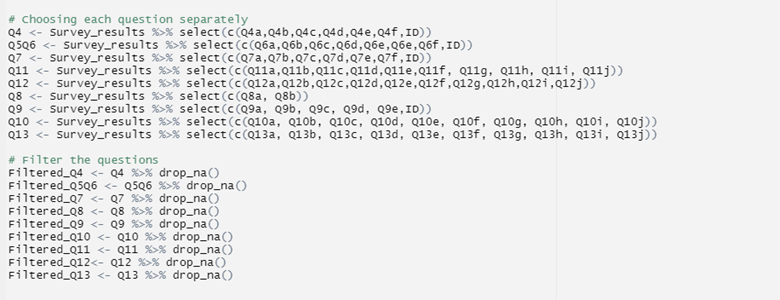

The analysis process began with data cleaning, which involved de-duping, formatting, and replacing empty responses with NA values, among other steps. This was essential to ensure that the data was accurate and could be analyzed properly.

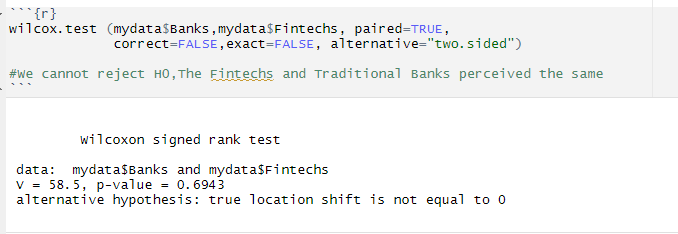

Once the data was cleaned, we began the statistical analysis process. This involved testing the formulated hypotheses using appropriate statistical tests, such as one-way ANOVA, Friedman ANOVA, and Wilcoxon, in R. Statistically significant differences (p < 0.05) were reported where they existed. Due to the small sample size, we disregarded Bonferroni’s correction.

Results of analysis

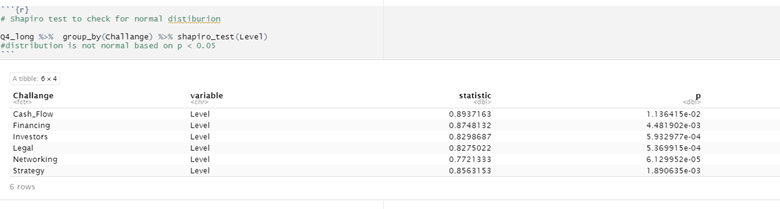

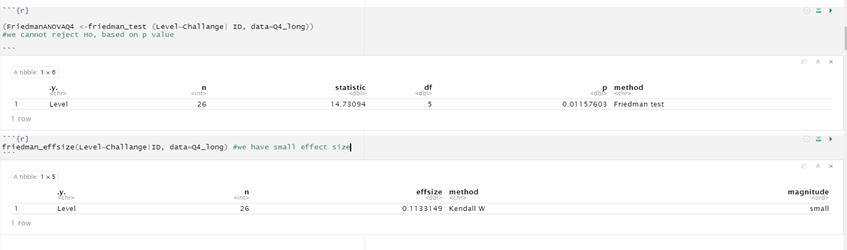

What are the main concerns of startups?

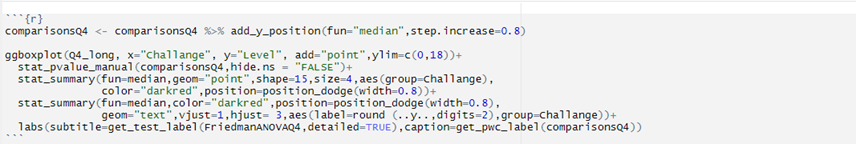

According to the survey results, startup concerns are predominantly non-financial. The respondents rated the importance of various challenges on a scale of 1 to 5, including financing operations, finding investors, networking, legal issues, and cash flow. A Friedman ANOVA analysis revealed that cash flow (Mean= 3.0) was the major challenge for startups, followed by legal concerns (Mean=2.00), strategy (Mean=2.00), and networking (Mean=1.50).

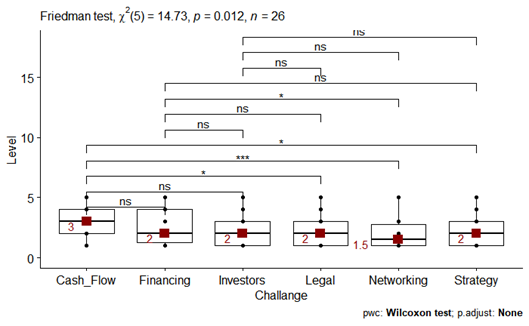

#Check for normal distribution by performing the Shapiro test.

H0: Distribution is normal

H1: Distribution is not normal

# To get insights by comparing dependent variables to each other

What is the main attribute when deciding on a bank?

In our survey, startups were asked to rate the key characteristics they consider when selecting a financial services provider on a scale of 1 to 7, with 1 being not important and 7 being very important. The analysis revealed that attention to customer service (Mean=5.00) was ranked as the most important attribute, followed by online banking (Mean=5.00), trustworthiness (Mean=5.00), and fee (Mean=4.00). Location was found to be the least important criterion for startups.

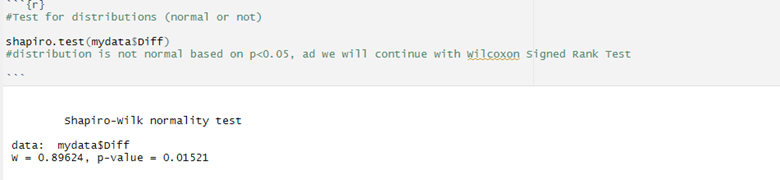

Whom do startups trust more – traditional banks or fintech?

In the survey, respondents were asked to rate traditional banks and fintech based on trustworthiness. The analysis revealed that there was no statistically significant difference in the level of trustworthiness perceived by startups between traditional banks and fintech. This indicates that startups trust both financial institutions equally when it comes to trustworthiness.

#Check for normal distribution by performing the Shapiro test.

H0: Distribution is normal

H1: Distribution is not normal

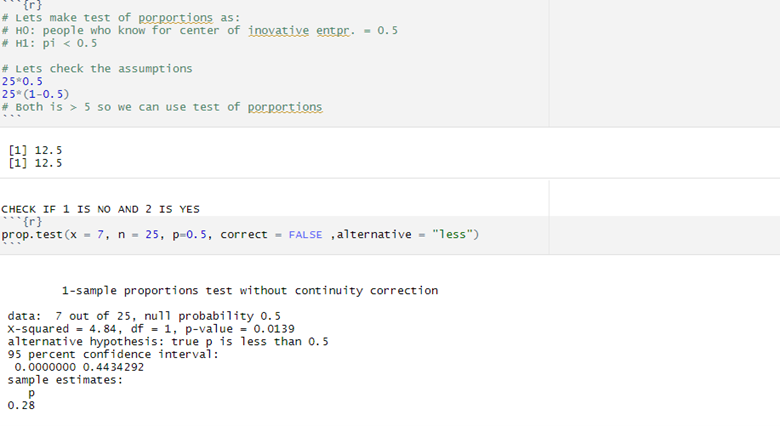

Do startups know about the Center of Innovative Entrepreneurship?

The respondents were asked if they had ever heard of the Center for Innovative Entrepreneurship. From the results, I can conclude that the majority of startups do not know about the existence of the Center for Innovative Entrepreneurship. Only 28% of the respondents know about the existence.

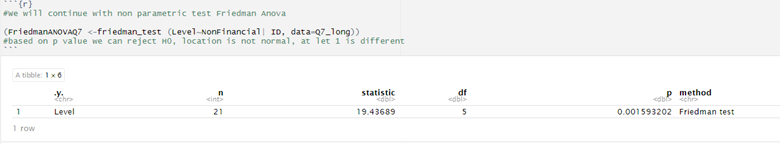

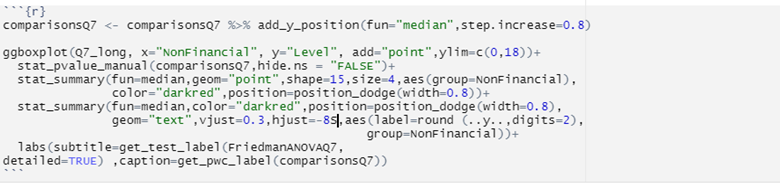

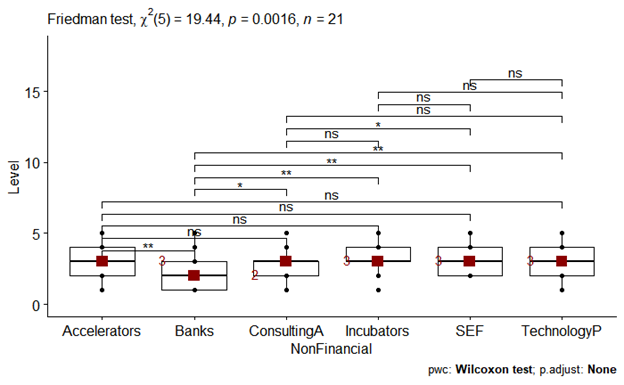

Whom do startups consider as a source of non-financial support?

The data indicates that startups do not view banks as significant non-financial support providers. Instead, startups consider accelerators (Mean=3.00), incubators (Mean=3.00), and consulting (Mean=3.00) as the main non-financial supporters. In comparison to the Slovene Enterprise Fund (SEF) and the technology park, the results demonstrate that startups prefer the technology park (Mean=3.00) and SEF (Mean=3.00) over the bank (Mean=2.00) as non-financial support.

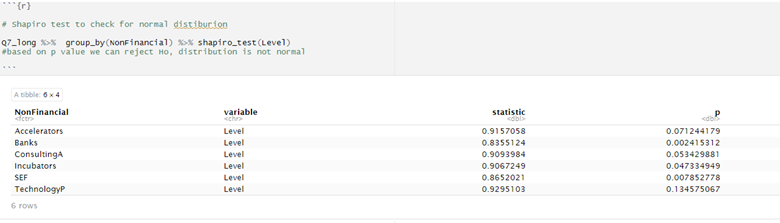

#Check for normal distribution by performing the Shapiro test.

H0: Distribution is normal

H1: Distribution is not normal

Recommendations

Facilitating connections and building relationships

Startups often face challenges in identifying and reaching their target customers, given the specificity and innovation of their products. The bank’s extensive network and deep understanding of its clients’ needs and pain points position it well to help connect startups with potential customers. I recommend that the bank leverage its experience and relationships to facilitate such connections, thereby helping startups to gain greater market exposure and customer traction.

Selling Bank Accounts to Startups

To enhance its relationship with startups, the bank should consider offering free workshops as part of its account package. These workshops can serve as a unique selling point for the bank and differentiate it from competitors. As the data analysis revealed, startups prioritize non-financial attributes when choosing a bank, and offering workshops can demonstrate the bank’s commitment to supporting the growth and success of its startup clients. Through these workshops, the bank can provide valuable insights and knowledge to startups, helping them to better manage their finances, understand the banking system, and connect with potential customers.

Improving Center Of Innovative Entrepreneurship

- To increase awareness and improve the perception of the Center for Innovative Entrepreneurship, the bank should promote it more actively on social media and other channels. Currently, many startups are not aware of its existence and do not understand its goals and services.

- The current workshops offered by the Center may not be meeting the needs of startups, as the survey data shows that startups are facing primarily non-financial challenges. Therefore, the bank should consider updating and enhancing the content of its workshops to provide more value to startups, focusing on topics related to overcoming these challenges with expert-led seminars and workshops.

- By doing so, the bank can position itself as a valuable non-financial support provider and build stronger relationships with startups.